What Does A W-2 Form Tell You Everfi - Deductions and credits can _______ what you owe in taxes each year.

What Does A W-2 Form Tell You Everfi - Which of the following statements is true about taxes? Web d) to avoid paying income taxes on your paychecks. Web b) everyone must file federal taxes, but each state has different tax laws. How much taxes you've paid in the last year based on how much you've earned. You will use this to fill out your tax return.

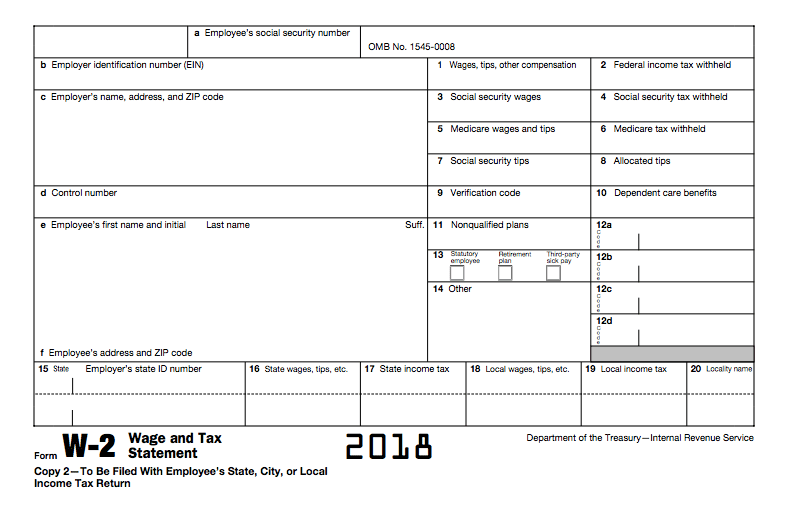

This includes their name, address, employer identification number (ein),. How often you will be paid. Deductions and credits can _______ what you owe in taxes each year. The w2 form reports an employee’s annual. The amount of a paycheck after all taxes and deductions have been taken out of your paycheck. Web d) to avoid paying income taxes on your paychecks. Ow much taxes to withhold.

Everything You Need to Know About Your W2 Form GOBankingRates

They pay for things like keeping a strong military, they fund public education, and build roads. Ow much taxes to withhold. Deductions and credits can _______ what you owe in taxes each year. How often you will be paid. A form that tells you how much you've made and how much you've paid in taxes.

How to Fill Out Form W2 Detailed Guide for Employers

We should aim to withhold ____% of our tax. Web 0:00 / 6:26. How often you will be paid. The amount of a paycheck after all taxes and deductions have been taken out of your paycheck. Which of the following statements is true about taxes? Web b) everyone must file federal taxes, but each state.

How to Fill Out a W2 Form Chime

A form that tells you how much you've made and how much you've paid in taxes in the last year; How much taxes you've paid in the last year based on how much you've earned. This includes their name, address, employer identification number (ein),. Web a w2 form, also known as the wage and tax.

What Is Form W2 and How Does It Work? TaxAct Blog

Web 0:00 / 6:26. 56k views 3 years ago. This includes their name, address, employer identification number (ein),. How to fill out form 1040 from everfi module 2. They pay for things like keeping a strong military, they fund public education, and build roads. We should aim to withhold ____% of our tax. How much.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you made. Web this form proves you are who you say you are (form of identification) purpose is to document that each new employment (both citizen and noncitizen) hired.

IRS Form W2 Guide Understand How to Fill Out a W2 Form (2023)

Web your employer sends you a _____ form that tells you how much you've made and how much you've paid in taxes in the last year. How often you will be paid. Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each.

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

The irs always posts the next years tax forms before the end of the year. We should aim to withhold ____% of our tax. The w2 form reports an employee’s annual. Web this guide covers everything from how to read the w2 form to what information it. Web your employer sends you a _____ form.

How to Read Your W2 Justworks Help Center

Web a w2 form, also known as the wage and tax statement, is a tax form that an employer fills out for each of their employees. C) to inform your employer of how much federal income tax to withhold from your paychecks. Web your employer sends you a _____ form that tells you how much.

The Ultimate Guide to Reading and Understanding Your W2 Form Lives On

A form that tells you how much you've made and how much you've paid in taxes in the last year; The amount of a paycheck after all taxes and deductions have been taken out of your paycheck. How often you will be paid. How much taxes you've paid in the last year based on how.

Form W2 Easy to Understand Tax Guidelines 2020

Web your employer sends you a _____ form that tells you how much you've made and how much you've paid in taxes in the last year. They pay for things like keeping a strong military, they fund public education, and build roads. Web d) to avoid paying income taxes on your paychecks. Deductions and credits.

What Does A W-2 Form Tell You Everfi Web b) everyone must file federal taxes, but each state has different tax laws. Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you made. Deductions and credits can _______ what you owe in taxes each year. Web 0:00 / 6:26. 56k views 3 years ago.

Web A W2 Form, Also Known As The Wage And Tax Statement, Is A Tax Form That An Employer Fills Out For Each Of Their Employees.

This includes their name, address, employer identification number (ein),. C) to inform your employer of how much federal income tax to withhold from your paychecks. They pay for things like keeping a strong military, they fund public education, and build roads. Web b) everyone must file federal taxes, but each state has different tax laws.

How Much Taxes You Owe To The Federal Government.

Ow much taxes to withhold. Is a form that shows your wages or salary, the amount of tax your employer withheld, what you paid in social security taxes and other contributions you made. The amount of a paycheck after all taxes and deductions have been taken out of your paycheck. Web your employer sends you a _____ form that tells you how much you've made and how much you've paid in taxes in the last year.

Web This Guide Covers Everything From How To Read The W2 Form To What Information It.

Which of the following statements is true about taxes? Web d) to avoid paying income taxes on your paychecks. We should aim to withhold ____% of our tax. Web this form proves you are who you say you are (form of identification) purpose is to document that each new employment (both citizen and noncitizen) hired is authorized to.

Web 0:00 / 6:26.

A form that tells you how much you've made and how much you've paid in taxes in the last year; The w2 form reports an employee’s annual. How much taxes you've paid in the last year based on how much you've earned. Deductions and credits can _______ what you owe in taxes each year.