Virginia Form 502A - Web you must meet all required conditions to be able to file form 502ez.

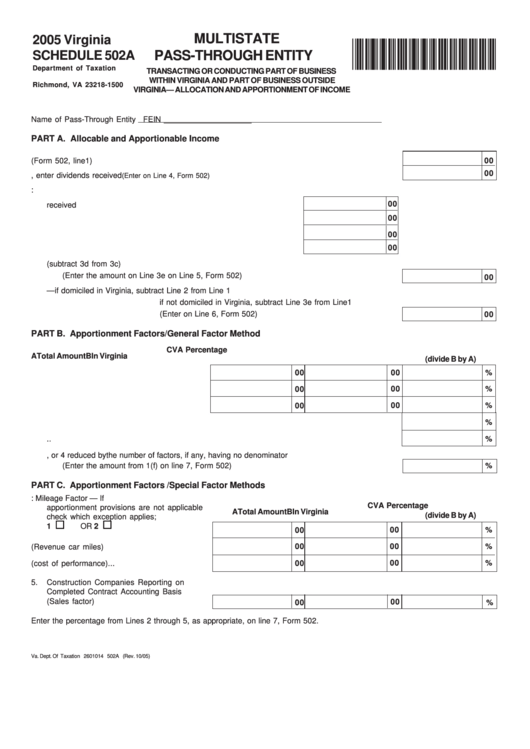

Virginia Form 502A - Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. To ensure this corporation is eligible to file form 502ez, please check the boxes below: Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. Web you must meet all required conditions to be able to file form 502ez.

Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. This form is for income earned in tax year. Web this package is provided for informational use only. Web 7.virginia apportionment percentage from schedule 502a, section b, percent from line 1 or line 2(f) or 100%. All other cases, the pte must prepare a schedule 502a.

Fillable Virginia Schedule 502a Multistate PassThrough Entity

Web virginia form 502a community discussions taxes state tax filing countingcat level 3 virginia form 502a turbo tax business insists i make a selection. Web 2020 virginia *va502a120888* schedule 502a. If the pte’s income is all from virginia, then the entity does. Web 2019 virginia *va502a119888* schedule 502a. If the pte’s income is all from.

Schedule 502a Multistate PassThrough Entity 2011 printable pdf

If the pte’s income is all from virginia, then the entity does. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, whichever is the greater of the late payment penalty, imposed. Web you must meet all required conditions to.

Virginia Form VA4 Printable (Employee's Withholding Exemption Certificate)

Web 7.virginia apportionment percentage from schedule 502a, section b, percent from line 1 or line 2(f) or 100%. If the pte’s income is all from virginia, then the entity does. Web form 502 is a virginia corporate income tax form. The resulting tax due must be submitted within one year of the final determination date..

Schedule 502a Multistate PassThrough Entity 2006 printable pdf

Previously s corporations were required to file their virginia income tax return on form 500s. This form is for income earned in tax year. Virginia department of taxation rev. If the pte’s income is all from virginia, then the entity does. Web report adjustments to virginia income as a result of the federal audit. Web.

Schedule 502a Multistate PassThrough Entity 2005 printable pdf

Web report adjustments to virginia income as a result of the federal audit. Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. Web more about the virginia form 502a we last updated virginia form 502a in january 2023 from the virginia department of taxation. See the.

Top 11 Virginia Form 502 Templates free to download in PDF format

See the instructions for information about electronic filing. Web form 765, virginia unified nonresident individual income tax return (composite return), may also be filed. Web virginia form 502a community discussions taxes state tax filing countingcat level 3 virginia form 502a turbo tax business insists i make a selection. Previously s corporations were required to file.

Fillable Virginia Schedule 502a Multistate PassThrough Entity 2014

Web virginia forms and schedules form 200—virginia litter tax return form 301*—enterprise zone credit form 500—virginia corporation income tax return. Web more about the virginia form 502a we last updated virginia form 502a in january 2023 from the virginia department of taxation. Virginia department of taxation rev. If the pte’s income is all from virginia,.

Form 502V Download Fillable PDF or Fill Online Virginia PassThrough

Web report adjustments to virginia income as a result of the federal audit. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, whichever is the greater of the late payment penalty, imposed. Virginia department of taxation rev. Web more.

Va Form 10 2850c Printable Printable Form 2023

To ensure this corporation is eligible to file form 502ez, please check the boxes below: If the pte’s income is all from virginia, then the entity does. See the instructions for information about electronic filing. The resulting tax due must be submitted within one year of the final determination date. This form is for income.

Form IT140 NRC Download Printable PDF or Fill Online West Virginia

All other cases, the pte must prepare a schedule 502a. Web 2019 virginia *va502a119888* schedule 502a. Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. Web form 502 is a virginia corporate income tax form. To ensure this corporation.

Virginia Form 502A Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage. Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, whichever is the greater of the late payment penalty, imposed. Web form 765, virginia unified nonresident individual income tax return (composite return), may also be filed. Web report adjustments to virginia income as a result of the federal audit. Web virginia forms and schedules form 200—virginia litter tax return form 301*—enterprise zone credit form 500—virginia corporation income tax return.

Web Report Adjustments To Virginia Income As A Result Of The Federal Audit.

Web the form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding. To ensure this corporation is eligible to file form 502ez, please check the boxes below: Web if form 502 is filed more than 6 months after the due date or more than 30 days after the federal extended due date, whichever is the greater of the late payment penalty, imposed. Web schedule 502a is used to show the amount of allocated income and to determine the apportionment percentage.

Web Schedule 502A Is Used To Show The Amount Of Allocated Income And To Determine The Apportionment Percentage.

If the pte’s income is all from virginia, then the entity does. Virginia department of taxation rev. If the pte’s income is all from virginia, then the entity does. Web form 765, virginia unified nonresident individual income tax return (composite return), may also be filed.

Web Virginia Forms And Schedules Form 200—Virginia Litter Tax Return Form 301*—Enterprise Zone Credit Form 500—Virginia Corporation Income Tax Return.

Web this package is provided for informational use only. Web you must meet all required conditions to be able to file form 502ez. Web 2020 virginia *va502a120888* schedule 502a. Web 7.virginia apportionment percentage from schedule 502a, section b, percent from line 1 or line 2(f) or 100%.

Web 2019 Virginia *Va502A119888* Schedule 502A.

The resulting tax due must be submitted within one year of the final determination date. Previously s corporations were required to file their virginia income tax return on form 500s. See the instructions for information about electronic filing. All other cases, the pte must prepare a schedule 502a.