Kansas Form K 40 - Web kansas only tax return the irs.

Kansas Form K 40 - Enter the result here and on line 18 of. Single resident number of exemptions claimed on your 2003 federal. Enter on line 8 of. Web adjusted gross income chart for use tax computation. 1) your kansas income tax balance due, after.

Single resident number of exemptions claimed on your 2003 federal. Get ready for tax season deadlines by completing any required tax forms today. Enter the result here and. Web how to file your estimated tax. Web credit may reduce your kansas tax liability. Kansas — individual income tax return. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the.

2015 Form KS DoR K40Fill Online, Printable, Fillable, Blank pdfFiller

Web credit may reduce your kansas tax liability. Web kansas only tax return the irs. Enter the result here and. Enter on line 8 of. Single resident number of exemptions claimed on your 2003 federal. Please use the link below. It appears you don't have a pdf plugin for this browser. Any partnership or s.

Form K40h Kansas Homestead Claim 2010 printable pdf download

Single resident number of exemptions claimed on your 2003 federal. 1) your kansas income tax balance due, after. Answer only the questions that apply to you. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Web to qualify for this property tax refund you must have been a resident.

Kansas k4 form 2019 Fill out & sign online DocHub

Estimated tax payments are required if: Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. Web how to file your estimated tax. 1) your kansas income tax balance due, after. Web kansas only tax return the irs. Answer only.

Fillable Form K40 Pt Kansas Property Tax Relief Claim 2012

Web credit may reduce your kansas tax liability. Enter the result here and on line 18 of. Please use the link below. To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers. Web to qualify for this property tax refund you must have.

Fillable Form K40pt Kansas Property Tax Relief Claim For Low

Web how to file your estimated tax. Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. You can download or print current. The credit allowed for tax. You must be a kansas resident and have a valid social security.

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund

Enter the result here and. Please use the link below. Important information for the current tax year. You can download or print current. The credit allowed for tax. Web enter the result here and on line 18 of this form. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the..

Fillable Form K40 Kansas Individual Tax 2013 printable pdf

Enter on line 8 of. Kansas — individual income tax return. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Kansas income tax, kansas dept. Do not send the kansas department of revenue a copy of your form. Important information for the current tax year. Single resident number of.

Kansas k40 form Fill out & sign online DocHub

Get ready for tax season deadlines by completing any required tax forms today. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Important information for the current tax year. Estimated tax payments are required if: Single resident number of exemptions claimed on your 2003 federal. Kansas — individual income.

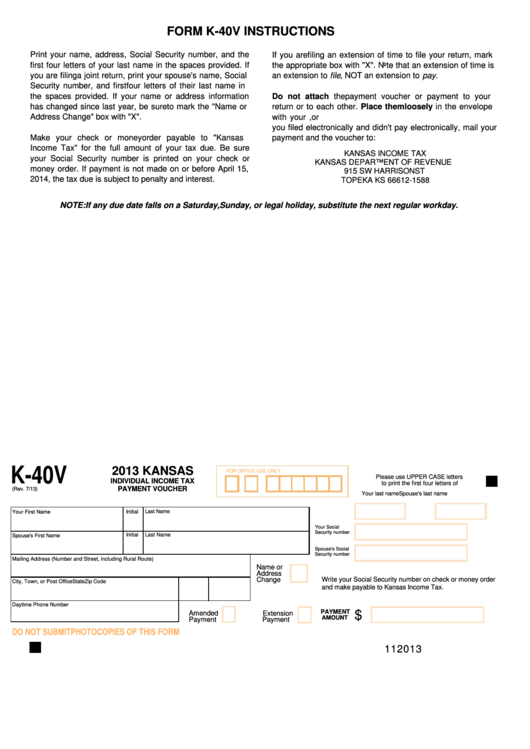

Fillable Form K40v Kansas Individual Tax Payment Voucher

Web enter the result here and on line 18 of this form. Enter on line 8 of. 1) your kansas income tax balance due, after. Estimated tax payments are required if: Filing status (mark one) residency status (mark one) exemptions. Answer only the questions that apply to you. Get ready for tax season deadlines by.

K40 2012 Kansas Individual Tax printable pdf download

Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers. Important information for the current tax year. The credit allowed for tax. Answer only.

Kansas Form K 40 Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Enter on line 8 of. You can download or print current. Please use the link below. To ensure the most eficient processing of your payments, it is important that you use only black ink to complete the vouchers.

You Can Download Or Print Current.

Web to qualify for this property tax refund you must have been a resident of kansas the entire year of 2022 and own your home. It appears you don't have a pdf plugin for this browser. Do not send the kansas department of revenue a copy of your form. Enter the result here and on line 18 of.

Web Enter The Result Here And On Line 18 Of This Form.

Single resident number of exemptions claimed on your 2003 federal. Important —if you are claimed as a dependent by another taxpayer, enter “0” in the. Kansas income tax, kansas dept. Enter on line 8 of.

To Ensure The Most Eficient Processing Of Your Payments, It Is Important That You Use Only Black Ink To Complete The Vouchers.

Enter the result here and. Kansas — individual income tax return. Any partnership or s corporation required to file a kansas income tax return may elect to file a composite. Web if this is an amended 2018 kansas return mark one of the following boxes:

You Must Be A Kansas Resident And Have A Valid Social Security Number For All Individuals On Your Return.

Get ready for tax season deadlines by completing any required tax forms today. Enter the total number of exemptions in the total kansas exemptions box. Estimated tax payments are required if: Filing status (mark one) residency status (mark one) exemptions.