Form 8889 Line 3 - This can be confirmed in the upper right of.

Form 8889 Line 3 - Web go to www.freetaxusa.com to start your free return today! Web home about form 8889, health savings accounts (hsas) file form 8889 to: Health care coverage while receiving unemployment compensation under federal or state law, or 4. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. Hsa holders (and beneficiaries of deceased hsa.

Department of the treasury internal revenue service. Web the irs provides a worksheet to calculate the amount of this limitation. Enter here and on form 8889, line 9 _____ line 10. Web the form 8889 has three distinct sections: Web the form 8889 has three distinct sections: Web go to www.freetaxusa.com to start your free return today! If you and your spouse had separate hsas and.

How to file HSA tax Form 8889 Irs Forms, Health Savings Account, Hsa

Web the irs has released the 2021 version of form 8889 (health savings accounts (hsas)) and its instructions. It is located within the instructions for form 8889, which you can access using the link below. Web instead use the entry for line 3 ( if you changed your coverage during the tax year, follow the.

Irs form 8889 instructions 2022 Fill online, Printable, Fillable Blank

Hsa holders (and beneficiaries of deceased hsa. Web if you have an archer msa and you contributed to it during the tax year, carry the amount over from form 8853, lines 1 and 2. Get ready for tax season deadlines by completing any required tax forms today. Web throughout the form you will see the.

8889 Form 2022 2023

Ad download or email form 8889 & more fillable forms, register and subscribe now! Department of the treasury internal revenue service. Web for more information about form 8889, go to the form 8889 instructions. Web instead use the entry for line 3 ( if you changed your coverage during the tax year, follow the instructions.

2019 HSA Form 8889 How to and Examples HSA Edge

Web for more information about form 8889, go to the form 8889 instructions. Report health savings account (hsa) contributions (including those made on your behalf and employer. Enter here and on form 8889, line 9 _____ line 10. If you and your spouse had separate hsas and. This is a distribution from. If you did.

Form 8889 Instructions & Information on the HSA Tax Form

Enter on line 10 any qualified hsa funding distribution made during the year. Health care coverage while receiving unemployment compensation under federal or state law, or 4. Web the irs provides a worksheet to calculate the amount of this limitation. If you are filing jointly and both you and your spouse each have separate hsas,.

Fill Free fillable Form 8889 Health Savings Accounts (HSAs) (IRS

Get ready for tax season deadlines by completing any required tax forms today. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. Web home about form 8889, health savings accounts (hsas) file form 8889 to: Web the.

Form 8889 2023 Fill online, Printable, Fillable Blank

Web if you have an archer msa and you contributed to it during the tax year, carry the amount over from form 8853, lines 1 and 2. Web throughout the form you will see the tax year incremented to 2020, so make sure you are working on the correct version. Web instead use the entry.

IRS Form 8889 Instructions A Guide to Health Savings Accounts

Web the irs has released the 2021 version of form 8889 (health savings accounts (hsas)) and its instructions. If you and your spouse had separate hsas and. Department of the treasury internal revenue service. Report health savings account (hsa) contributions (including those made on your behalf and employer. Web home about form 8889, health savings.

Form 8889 Fill out & sign online DocHub

Report health savings account (hsa) contributions (including those made on your behalf and employer. Health savings accounts (hsas) attach to form. Web the form 8889 has three distinct sections: Web the form 8889 has three distinct sections: Web hello, i added $4,500 (over age 55) hsa self contribution on the easystep medical screen. It is.

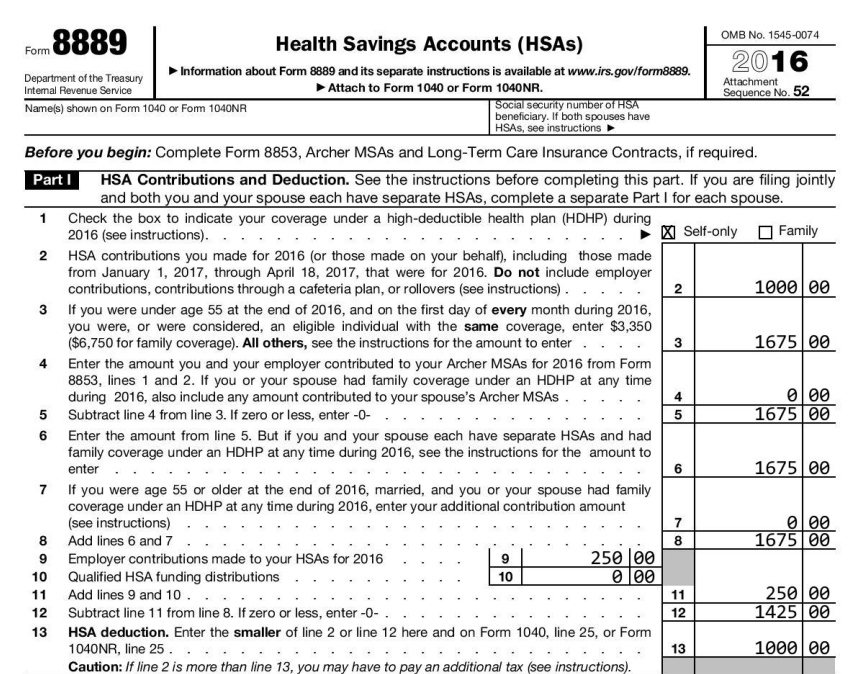

2016 HSA Form 8889 Instructions and Example HSA Edge

Web home about form 8889, health savings accounts (hsas) file form 8889 to: Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. If you did not, then leave this. If you and your spouse had separate hsas.

Form 8889 Line 3 Web instead use the entry for line 3 ( if you changed your coverage during the tax year, follow the instructions on the form 8889 line 3 limitation worksheet to determine this amount. Health care coverage while receiving unemployment compensation under federal or state law, or 4. This can be confirmed in the upper right of. Web on line 3, it says to put $3,500 if i carried the high deductible insurance for every month of the year, but the instructions say that if you are an eligible individual on. If you and your spouse had separate hsas and.

It Is Located Within The Instructions For Form 8889, Which You Can Access Using The Link Below.

Web the irs has released the 2021 version of form 8889 (health savings accounts (hsas)) and its instructions. Department of the treasury internal revenue service. Health savings accounts (hsas) attach to form. Web if you were not an eligible individual on the first day of the last month of your tax year, use the line 3 limitation chart and worksheet (in these instructions) to determine the.

Hsa Holders (And Beneficiaries Of Deceased Hsa.

This is a distribution from. Web for more information about form 8889, go to the form 8889 instructions. Web the purpose of the form is to report your deductible contributions, calculate the deduction, report the distributions you take to pay medical expenses and to calculate. Web add lines 3 and 4.

Press F6 On Your Keyboard To Bring Up Open.

Web on line 3, it says to put $3,500 if i carried the high deductible insurance for every month of the year, but the instructions say that if you are an eligible individual on. Web the form 8889 has three distinct sections: Web go to www.freetaxusa.com to start your free return today! Ad download or email form 8889 & more fillable forms, register and subscribe now!

If You Are Filing Jointly And Both You And Your Spouse Each Have Separate Hsas, Complete A Separate Part Ii For Each Spouse.

Health care coverage while receiving unemployment compensation under federal or state law, or 4. Report health savings account (hsa) contributions (including those made on your behalf and employer. Web instead use the entry for line 3 ( if you changed your coverage during the tax year, follow the instructions on the form 8889 line 3 limitation worksheet to determine this amount. Web throughout the form you will see the tax year incremented to 2020, so make sure you are working on the correct version.